Last week, NPCI started a consumer content sourcing initiative STOP. Taking this ahead, Panchal says, "NPCI started with the Consumer Safety & Awareness program leveraging the mass media vehicles like newspapers and radio. So far, number of such fraud cases are few (5 cases reported so far), NCPI adds, "we are vigilant and urge consumers to be careful." using the apps available on the victim’s phone or even steal any information stored in the mobile phone. Once access is granted by the victim, fraudster can not only initiate financial transactions but can also place online shopping orders or book rail/air tickets, etc.

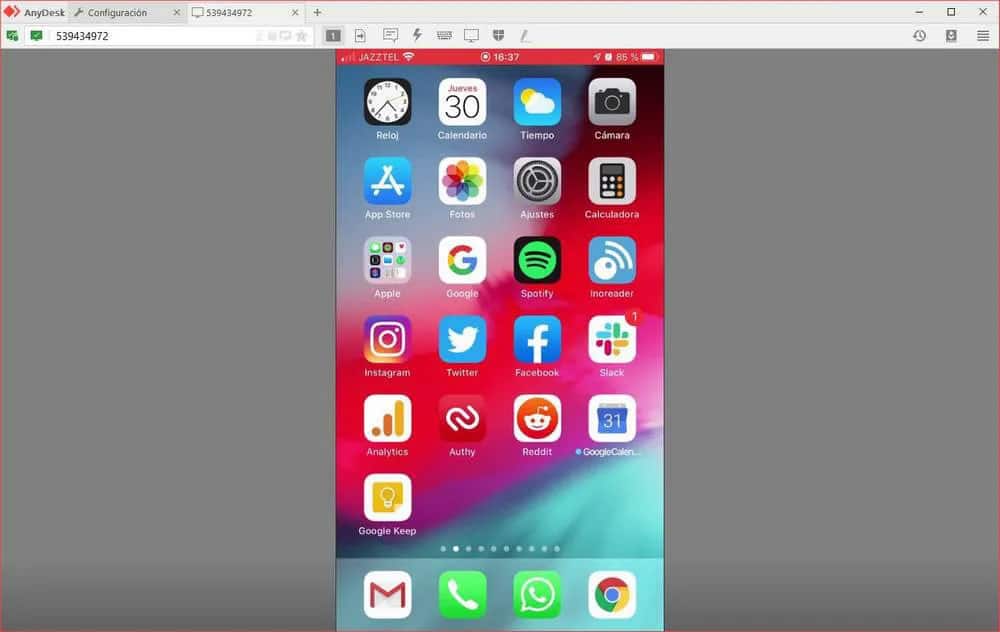

Further the mobile app credential is vished from the customer and the fraudster then can carry out transactions through the mobile app already installed on the customer’s device. Post this, fraudster will gain access to victim’s device. Once fraudster inserts this app code (9-digit number) on his device, he would ask the victim to grant certain permissions which are similar to what are required while using other apps. The app code (9-digit number) would be generated on victim’s device which the fraudster would ask the victim to share. Fraudster would lure the victim on some pretext to download an app called ‘AnyDesk’ from Playstore or Appstore. The entire ecosystem including Banks & Fintech companies have to work collectively towards creating awareness & educating customers to refrain from sharing their account/card credentials, OTP/PIN and/or giving access to their mobile handsets to unscrupulous persons through such remote screen access apps." NCPI has also mentioned few steps a customer can take in regards to have a safe and secure digital transaction.īharat Panchal, Head of Risk Management, NPCI says, “While NPCI is continuously working towards enhancing security of its products & services from such attacks, this type of frauds can be better prevented by consumer education. Now, UPI operator NCPI has issued warning and guidelines to customers, explaining how AnyDesk lures them into a fraud. RBI said that the cautionary notice was issued in the wake of rising number of fraud using the UPI platform.

RBI alerted banks about potential fraudulent transactions on the unified payments interface (UPI) platform. The app came to limelight when the Reserve Bank of India (RBI) issued a warning to customers, asking them not to download it. An app which robs money from your bank account - AnyDesk - is making a lot of noise these days.

0 kommentar(er)

0 kommentar(er)